Investment returns play an important role in the funded status of the COPERS Trust Fund because they provide the largest percentage of dollars needed to pay future benefits. In fact, for a typical public pension system, investment returns provide about 75% of the monies used to pay pension benefits.

This portion of the website describes the types of assets in which COPERS invests, and shows the returns on these investments over time.

We have attempted to present the information in a language that will be meaningful to a wide audience, although we recognize that some terms and financial content may be unfamiliar to some site visitors. We have provided definitions for many of the terms and phrases used at the bottom of this page.

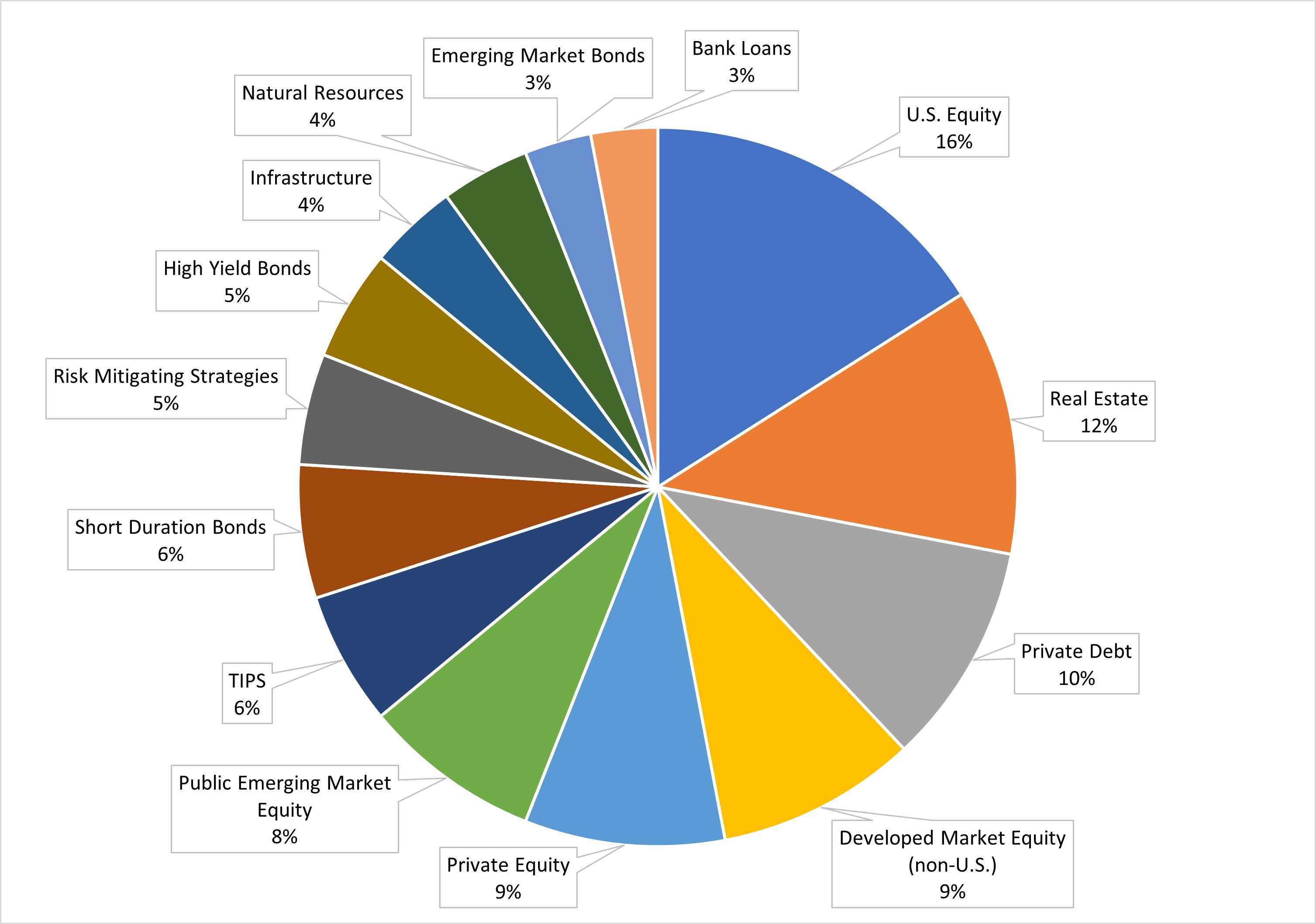

Asset allocation means investing funds across different markets or asset classes in an attempt to dampen the overall volatility of COPERS' investment returns. This decision of how to diversify the portfolio has a great influence on investment returns. The COPERS Board, in consultation with their general investment and real estate consultants, decides what risks are prudent to take and makes its asset allocation decisions by adopting a policy benchmark that identifies the portion of the Trust Fund to invest in each asset class. COPERS' investment staff periodically rebalance the Fund's investments to keep the portfolio in line with the policy benchmark, but variances may occur from time to time because of market conditions.

The COPERS Board carefully selects qualified investment managers to construct and manage asset class portfolios that work together. COPERS currently utilizes 26 investment managers.

Below are the asset allocation targets established by the COPERS Board. Note that the Investment Policy recognizes that it may take many months to fully implement some of the changes (especially allocations to other real assets), and that the policy benchmark will change as those asset classes are implemented.

COPERS Asset Allocation Targets

Target Allocations as a Percentage of Total Fund

Glossary of Terms:

U.S. Equity: Investment in the stocks of companies that are based in the United States.

Developed Market Equity (non U.S.): Developed markets equities refers to stocks of companies in nations that have a greater degree of economic development judged on economic size, income and the maturity of capital markets. They are relatively more open to foreign ownership and enjoy ease of capital movement, efficiency of market institutions, high levels of industrialization, a high standard of living and a large amount of widespread infrastructure.

Emerging Market Equity: Emerging market equities are publicly traded securities of companies located in countries in the process of building a market-based economy. Emerging market equity is generally more volatile than developed market equity. (Emerging markets comprise roughly 80% of the world's population and 37% of global economic output.)

Private Equity: Investment in the stock and debt of privately held companies. These investments are held in limited partnerships because they are not publicly traded and limit COPERS' volatility.

High Yield Bonds: Bonds where the credit rating is below BBB by Standard & Poor's or, Baa or lower by Moody's.

Bank Loans: Senior floating-rate loans made to corporations. These loans are typically used by firms to fund everything from working capital needs to acquisitions.

Emerging Market Bonds: Emerging market (EM) bonds are those issued by the sovereign entities of, and corporations in, developing foreign countries.

Private Debt: Loans that are typically made by non-bank investors. Companies typically access ivate debt to finance growth, expand their working capital, or fund real estate development.

TIPS: Investment in United States Treasury Inflation-Protected Securities and global inflation-linked bonds.

Real Estate: Investment in properties, and in the stocks of companies that manage properties, in the four major commercial real estate sectors (office, industrial, retail, and apartments).

Infrastructure: The underlying foundation of basic services, facilities, and institutions upon which a community depends. Can include investments in transportation (roads, bridges, airports), Environmental (water, waste, sanitation), Energy (pipelines, power generation and distribution), Communication (cable, internet, phone networks), and Social (hospitals, schools, parks).

Natural Resources: Investment in companies that harvest, produce, process, refine, transport and market commodities. Typically includes a large array of opportunities in primarily two categories: Exploration and Production: Oil, natural gas, coal, industrial and precious metals; and Environment and Land: Farmland, timberland, water rights, and wetlands.

Short Duration Bonds: Bonds that generally have a short timeframe of maturity.