Phoenix launches a Citywide food drive to assist residents experiencing food insecurity during the holidays.

Overview

The Youth and Education Office builds connections between City services, community resources, and public schools for students in K-12 to receive the necessary support to succeed.

The Youth and Education Office also coordinates the Youth and Education Commission, which consists of community members who provide policy guidance, develop educational initiatives, and identify resources for school-to-career transition.

Highlighted Programs and Services

Volunteer with us or learn more about the work we're doing to improve education in the Phoenix community.

-

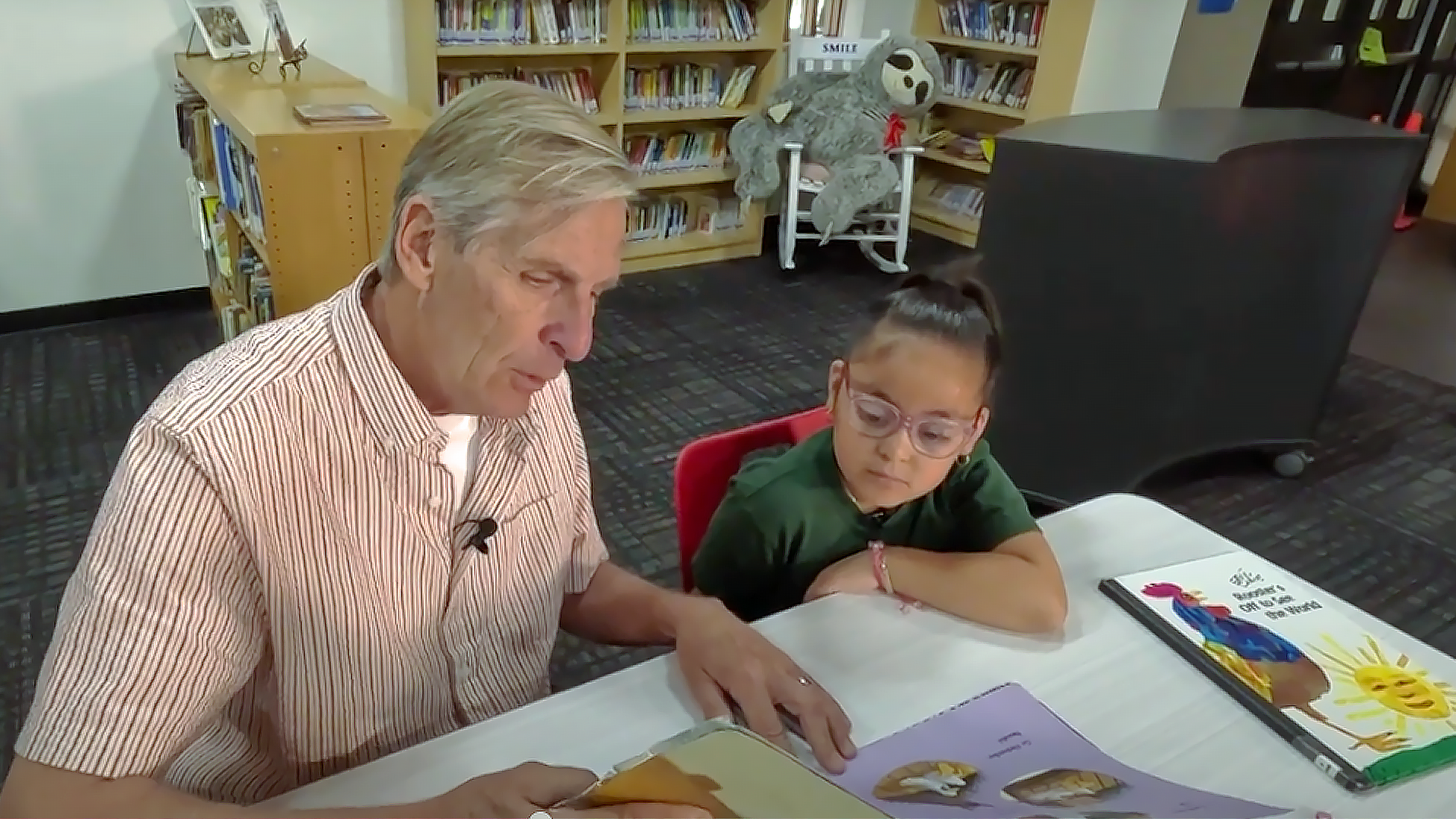

Experience Corps

We need volunteers to help children become proficient readers by the time they finish third grade.

-

PHX Arena Suite

Request tickets for youth to attend events at the PHX Arena.

-

Great Start Program

The Phoenix Great Start Program gives Phoenix children in Title I schools and their families free admission to several education and cultural centers.

-

Outstanding Youth Leader of the Year

The Outstanding Phoenix Youth Leader of the Year program recognizes and honors exceptional achievements by young people.

-

Read On Phoenix

Arizona is battling a literacy crisis. Our goal is simple: Every third-grader in our city will read proficiently.

-

Partner With a Principal

Between September 9 and October 18, corporate executives and community leaders work alongside public charter and private school principals for a day.

I Want To ...

-

Find a Phoenix School

Find school locations and district and attendance boundaries.

-

Get Ready for Kindergarten

The Great Start Program gives pre-K children free admission to several educational and cultural centers.

-

Enroll in Head Start

The Head Start Program provides early childhood development and support to income-eligible families.

-

Find a Resource Center

Resource centers are safe community hubs for families with children from birth to age five and pregnant mothers.

-

-

Contact the Youth and Education Office

General Inquiries: 602-262-6941

Email: mailbox.youth@phoenix.gov